Canada: The Canadian government will spend $8 million (~€6 million) to investigate the “charitable” tax-deduction status of Canadian environmental groups and others that often get much of their funding from foreign sources, and who spend much of these resources on political interference rather than environmental protection

This is no April Fool’s joke- the Canadian government has finally decided to look into the practise of environmental groups and others taking advantage of the generous provisions for tax exemptions enjoyed by individual and corporate donors that give money to so-called “charitable” organizations. The inquiry will also look into the source of funding for many of the environmental groups operating in British Columbia, as a lot of foreign money given to these groups is suspected of being used for political purposes rather than truly charitable ones.

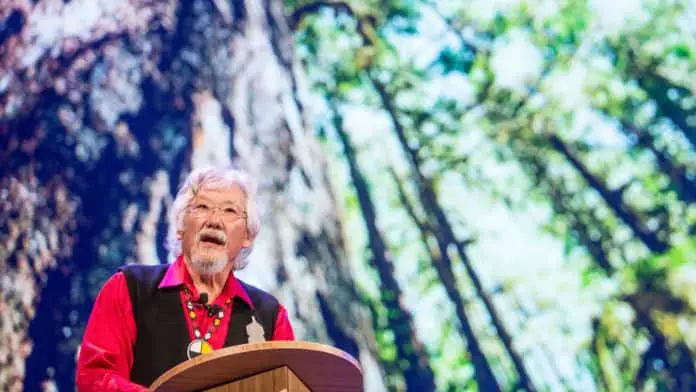

An example is the millions of dollars collected from US-based philanthropic foundations by the Vancouver-based David Suzuki Foundation, whose leader is now trying to get people to sign up for a protest against the Canadian government’s decision to look into its funding and political activism practises. When Dr. David Suzuki a few years ago publicly stated that he “wouldn’t feed his kids farmed salmon- it’s poison” he made an example of why his foundation is not focusing on science-based charitable activities but rather on ill-conceived efforts to influence political decisions against legitimate industrial activities.

The exposure of environmental groups and their use of foreign funding for so-called “charitable” tax-deductible activities has largely been the result of research into US and Canadian tax returns conducted by Vancouver-based Vivian Krause, whose efforts resulted in a commitment by the Canadian government to allocate $8 million over the next couple of years to look into the potential abuse of the system. The money was allocated in the 2012 federal budget which was released last month, and it is earmarked for the purpose “to ensure that charities devote their resources primarily to charitable, rather than political, activities, and to enhance public transparency and accountability in this area”.

In 2011, federal tax assistance for the charitable sector was approximately CAD $2.9 billion (~€2.1 billion). In its budget documentation, the government states that; “Recently, concerns have been raised that some charities may not be respecting the rules regarding political activities. There have also been calls for greater public transparency related to the political activities of charities, including the extent to which they may be funded by foreign sources”.

The government estimates that this investigation and the accompanying public reporting will cost about CAD$ 5 million during this fiscal year (2012/13) and an additional CAD$ 3 million next year. The government also proposes that “the Income Tax Act be amended to restrict the extent to which charities may fund the political activities of other qualified donees, and to introduce new sanctions for charities that exceed the limits on political activities, or that fail to provide complete and accurate information in relation to any aspect of their annual return”.

Many of the dozens of B.C.-based environmental groups that have been actively campaigning against the Province’s salmon farming industry on the basis of questionable information like David Suzuki’s “farmed salmon is poison” argument may soon be looking elsewhere for funds to carry on their political campaigns.